Phila Pizza Shop Owner Pleads Guilty To Tax Fraud

by Alex Lloyd Gross

Cihan Calkap, 42, of Drexel Hill, Pennsylvania is the owner of Mimmo’s Pizza. He just entered a guilty plea to one count of tax evasion after he was caught skimming the books and under paying is taxes. On top of that, US Attorney David Metcalf said that Calkap did not report all of his employees wages.

He had 25 employees but only paid taxes on four of them, the rest were paid in cash under the table, Metcalf said. The shop is located at 3000 W. Allegheney Ave. in North Philadelphia.

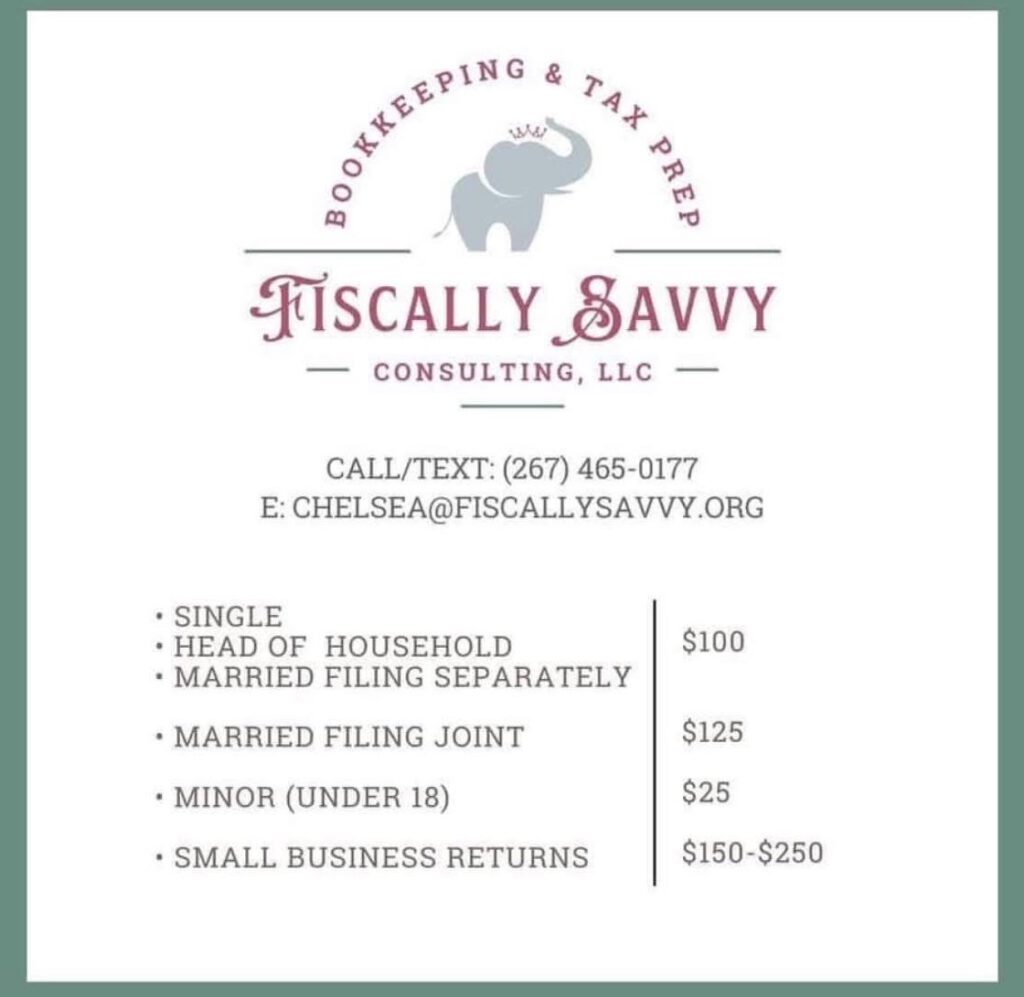

Calkap avoided paying taxes on this money by providing his accountant with incomplete information about the restaurant’s income and expenses. In particular, Calkap gave his return preparer access only to the business’s bank records, knowing that those records did not include all of the cash income. This caused the accountant to prepare false corporate and personal income tax returns on behalf of Mimmo’s and Calkap that were filed with the IRS. From 2015 to 2018, Calkap underreported Mimmo’s total receipts.

Calkap will be sentenced on May 14 and faces up to five years in federal prison, Metcalf said.